Let’s Get in Touch!

Use the form provided to tell us a little about your needs, and our team will follow up with you as soon as possible.

Benefits Solutions Design with Central Texas Businesses in Mind

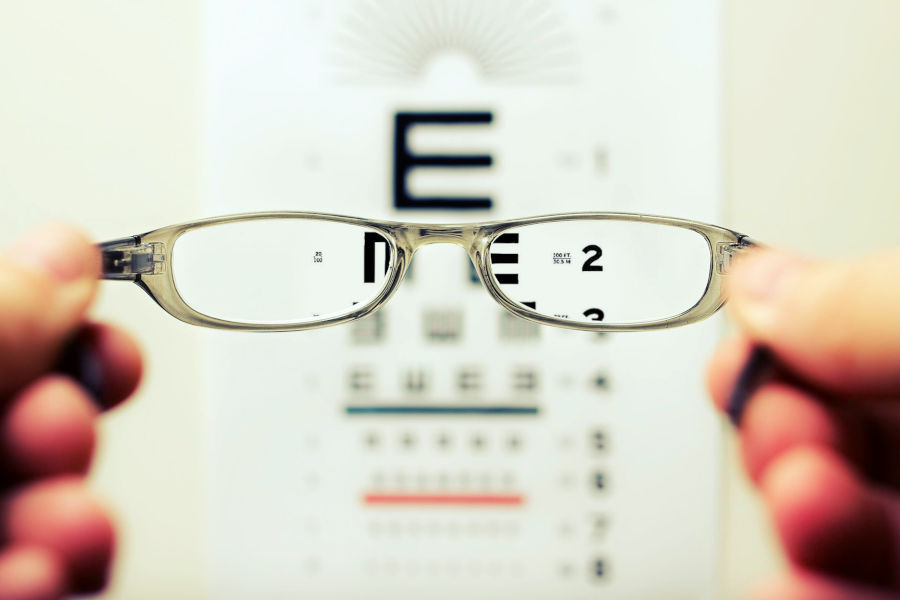

Most people don’t fully understand how the medical insurance market works. We remove the mystery through education regarding community rating and how rates are calculated using the employees’ demographics and potential usage of claims dollars for the larger clients. It’s important for business owners and consumers of health insurance to fully understand how insurance works.

For most businesses, employee benefits are the next most expensive expenditure after employee wages. You deserve to understand all the facets of the pricing and process to make an educated purchase of these benefits and we can help.

Because employees are the number one asset of any company, we work to provide a comprehensive and affordable benefits package so employers can attract and retain the talent they need to run their businesses.

A recent study found that 49% of employees don’t understand their employee benefits materials.

Are your employees part of that group?

Our FREE HR and benefits admin system includes all the training you need to be confident you’ve got your employees covered.

Hiring & Onboarding

Employee Communication

Compliance Documents

Employee Compensation Statement

Payroll Vendor Integration

Time Off

HR managers who do not fully automate say they lose an average of 13 hours a week manually completing tasks that could be automated.

Currently, PEOs employ 3.7 million worksite employees and have annual wages around $176 billion. These numbers are only expected to increase in the coming years, offering small businesses better benefits options and more HR resources. (business.com)

Explore all of your options today!

Keep these important considerations in mind.

For mid-year termination, the PEO will have to complete final taxes up to that date and provide W2’s for that period. Your employees will be considered new hires when you take them back. You will want to ensure you still have Federal and State Tax ID number prior to exiting. You will be responsible for W2s for the rest of that calendar year. Your employees will have two W2s from two employers. It is highly probable you will overpay the FUTA and SUTA for that year because the “cap” will start over.

There can be no lapse in coverage. You will want to carefully time the transition.

Some workers’ comp carriers may consider you a start-up company since you may not have had WC under your company’s name. This could negatively impact risk rating (MOD) and possibly the ability to obtain coverage.

A new payroll processor will be needed. Allow for plenty of lead time, prior to the PEO exit, to ensure a smooth transition. Coordinate with your insurance broker to avoid benefit related payroll deduction issues.

You will want to issue or reissue an employee handbook. You may have to coordinate some policies with that of the PEO (e.g. PTO/Leave, code of conduct, performance reviews, benefits, offboarding)

To allow for full insurance market and funding analysis, begin the process well in advance of the PEO exit. Some insurance carriers may consider you a start-up company because you have not had payroll and/or benefits under your name, and it’s highly likely the PEO will not release your claims data. If you have a waiting period for new hires, you will either have to get the carrier to waive it or you will have to pick up COBRA from the PEO during that period. If the PEO plan was fully or partially self-insured, you may have issues with continuing to get claims paid for claims incurred prior to your termination. You may be required to continue to pay administration fees until all claims are cleared. If the PEO plan was fully insured and had a deductible, your employees may have to submit EOBs to the new medical carrier to get deductible credit. It may be necessary to obtain HIPAA-credible coverage certificates for each employee.

In most cases, the PEO will be responsible to maintain COBRA for qualified participants prior to your termination.

Review the PEO contract related to this to confirm. This is important with the transition.

Each employee may have to arrange transfer of their PEO 401(K) into individual IRAs, and if rules permit, later transfer into your 401(k). Timing of deferrals with transfer of payroll processors will be critical to a smooth transition.

Be sure to review the PEO’s policies for vacation, sick leave, disability, FMLA and other forms of leave and how they might impact your departure. Establish your own policies immediately and document these in your handbook/manual. You may be responsible for anyone on disability leave at the time of your PEO termination; you may have agreed (in your PEO contract) to job restoration or other leave guarantees or rights. If your company has less than 50 employees and is not subject to full FMLA leave requirements, the PEO may have to retain that responsibility for anyone on FMLA at the time of your termination.

ACA and DOL compliance services should be considered when exiting a PEO. You will want to obtain these services through your benefits broker or other entity to ensure you remain in compliance with current regulations

The source of your HR advice will also need to be considered once you’ve exited the PEO.

You will want to consider how your employees will enroll in their benefits without the use of the PEO’s technology. Your benefits broker can assist with this.